Starting a non-tech venture can be an exciting and rewarding endeavor. However, one of the biggest challenges faced by entrepreneurs in this space is securing adequate funding to bring their ideas to life. While tech startups often have access to a wide range of funding options, non-tech ventures may require a different approach. In this article, we will explore various startup funding options specifically tailored for non-tech ventures. Whether you’re looking to start a restaurant, retail store, or service-based business, we’ve got you covered.

Understanding the Funding Landscape for Non-Tech Ventures

Before diving into specific funding options, it’s important to understand the unique challenges faced by non-tech ventures when it comes to securing funding. Unlike tech startups that often attract investors due to their potential for exponential growth and scalability, non-tech ventures typically have slower growth rates and may not offer the same level of return on investment.

Additionally, non-tech ventures often require significant upfront capital for physical assets such as inventory, equipment, or real estate. This can make it more challenging to secure traditional forms of financing like bank loans or lines of credit.

However, despite these challenges, there are still several viable funding options available for non-tech ventures. By exploring alternative sources of capital and leveraging creative financing strategies, entrepreneurs in this space can increase their chances of success.

Bootstrapping: Starting Small and Scaling Gradually

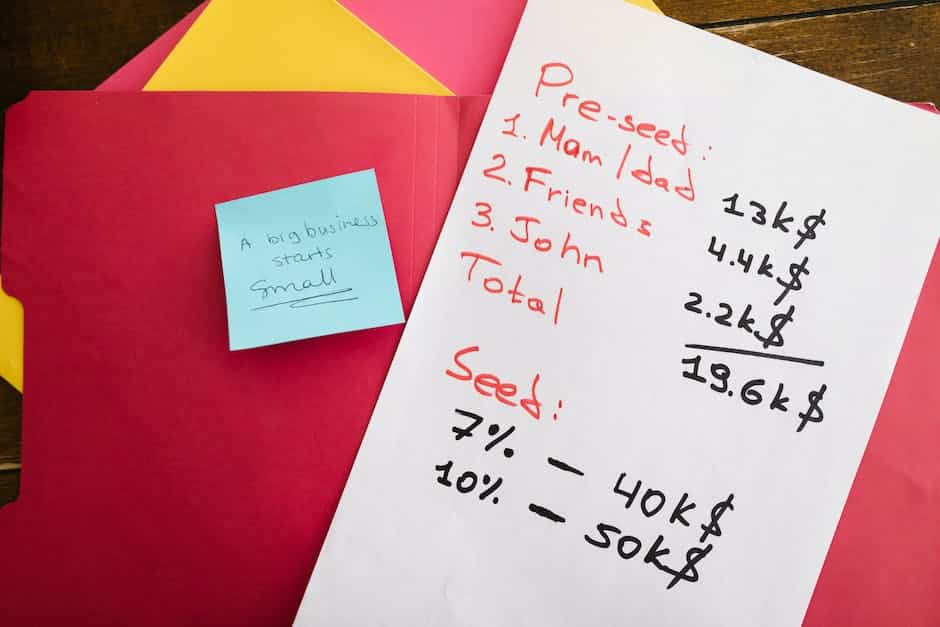

Bootstrapping is a popular funding option for many non-tech ventures. It involves starting with minimal external capital and relying on personal savings or revenue generated from early sales to fund initial operations. While bootstrapping may require entrepreneurs to make sacrifices in terms of growth rate or scale initially, it offers several advantages:

- Control: By bootstrapping your venture, you retain full control over decision-making processes without having to answer to external investors.

- Flexibility: Bootstrapping allows you to be agile and adapt quickly to market changes without being tied down by investor expectations.

- Proof of Concept: By generating revenue early on, you can validate your business model and demonstrate its viability to potential investors or lenders.

However, bootstrapping is not without its challenges. It requires careful financial planning, disciplined spending, and a willingness to take on multiple roles within the business. It may also limit your ability to scale rapidly or pursue aggressive growth strategies. Nonetheless, for non-tech ventures with limited access to external funding, bootstrapping can be an effective way to get started.

Friends and Family: Tapping into Personal Networks

Another common funding option for non-tech ventures is seeking investment from friends and family. This approach involves reaching out to individuals within your personal network who may be willing to invest in your venture. While this can be an effective way to secure initial capital, it’s important to approach these relationships with caution and transparency.

When seeking funding from friends and family, consider the following:

- Clear Expectations: Clearly communicate the risks involved in investing in a non-tech venture and set realistic expectations regarding returns on investment.

- Formal Agreements: Even when dealing with close acquaintances, it’s crucial to have formal agreements in place that outline the terms of the investment, repayment schedules (if applicable), and any other relevant details.

- Professionalism: Treat these investments as you would any other professional arrangement. Provide regular updates on the progress of your venture and maintain open lines of communication.

While securing funding from friends and family can provide a valuable source of capital, it’s important not to rely solely on this option. Diversifying your funding sources will help mitigate risk and ensure that you have access to additional resources if needed.

Crowdfunding: Harnessing the Power of the Crowd

In recent years, crowdfunding has emerged as a popular alternative funding option for startups across various industries. Crowdfunding platforms allow entrepreneurs to raise capital by soliciting small contributions from a large number of individuals. This approach not only provides access to funding but also serves as a marketing tool, allowing entrepreneurs to generate buzz and build a community around their venture.

There are several types of crowdfunding models available:

- Reward-based Crowdfunding: In this model, entrepreneurs offer rewards or incentives to individuals who contribute to their campaign. These rewards can range from early access to products or services, exclusive merchandise, or personalized experiences.

- Equity-based Crowdfunding: Equity crowdfunding allows entrepreneurs to sell shares of their company in exchange for capital. This model is particularly relevant for non-tech ventures that may not have the same potential for high growth as tech startups.

- Debt-based Crowdfunding: Debt-based crowdfunding involves raising funds through loans that are repaid with interest over time. This option can be attractive for non-tech ventures that have a clear revenue model and can demonstrate the ability to repay the loan.

When considering crowdfunding as a funding option, it’s important to carefully research and select the right platform for your venture. Each platform has its own set of rules, fees, and target audience, so choose one that aligns with your business goals and target market.

Grants and Government Programs: Tapping into Public Funding

For non-tech ventures operating in specific industries or sectors, grants and government programs can be an excellent source of funding. Governments at various levels often offer financial assistance programs designed to support entrepreneurship and economic development.

To identify relevant grants and programs for your venture:

- Research: Conduct thorough research on government websites, industry associations, or local business development centers to identify available funding opportunities.

- Eligibility Criteria: Review the eligibility criteria for each grant or program carefully to ensure that your venture meets the requirements.

- Application Process: Familiarize yourself with the application process and any supporting documentation that may be required. Pay attention to deadlines and ensure that you submit a well-prepared application.

While grants and government programs can provide significant financial support, it’s important to note that the application process can be competitive and time-consuming. Be prepared to invest time and effort into crafting a compelling application that clearly demonstrates the value of your venture.

Alternative Financing: Exploring Non-Traditional Options

In addition to the more traditional funding options discussed above, non-tech ventures can also explore alternative financing options. These options often involve leveraging non-traditional assets or revenue streams to secure capital. Here are a few examples:

- Asset-Based Lending: If your venture has valuable physical assets such as equipment, inventory, or real estate, you may be able to secure a loan using these assets as collateral.

- Revenue-Based Financing: Revenue-based financing involves securing capital in exchange for a percentage of future revenue. This option is particularly relevant for non-tech ventures with steady cash flow but limited access to traditional forms of financing.

- Supplier Financing: Some suppliers may offer financing options to their customers, allowing them to purchase inventory on credit terms. This can help alleviate the upfront costs associated with stocking inventory.

When considering alternative financing options, it’s important to carefully evaluate the terms and conditions associated with each option. Some alternative financing arrangements may come with higher interest rates or stricter repayment terms compared to traditional forms of financing.

Conclusion

Securing funding for non-tech ventures may require a different approach compared to tech startups. However, by exploring various funding options tailored specifically for non-tech ventures, entrepreneurs can increase their chances of success.

From bootstrapping and seeking investment from friends and family to crowdfunding, grants, government programs, and alternative financing options – there are several paths available for entrepreneurs in this space. The key is to thoroughly research each option, understand its pros and cons, and select the ones that align with your business goals and financial needs.

Remember, securing funding is just the first step. Once you have the capital in hand, it’s crucial to manage it wisely and use it strategically to fuel the growth of your non-tech venture. With careful planning, perseverance, and a solid business model, you can turn your entrepreneurial dreams into reality.