Starting a business is exciting, but finding the necessary funding can be daunting. While many entrepreneurs turn to investors for financial support, there are alternative ways to fund your startup without giving away equity or control. This article will explore strategies and resources to help you secure the necessary funds to bring your startup idea to life.

Bootstrapping: The Power of Self-Funding

Bootstrapping is starting and growing a business with little or no external capital. It allows you to control your startup fully while minimizing financial risks. You can fund your venture without investors by relying on your resources and creativity.

1. Personal Savings and Credit

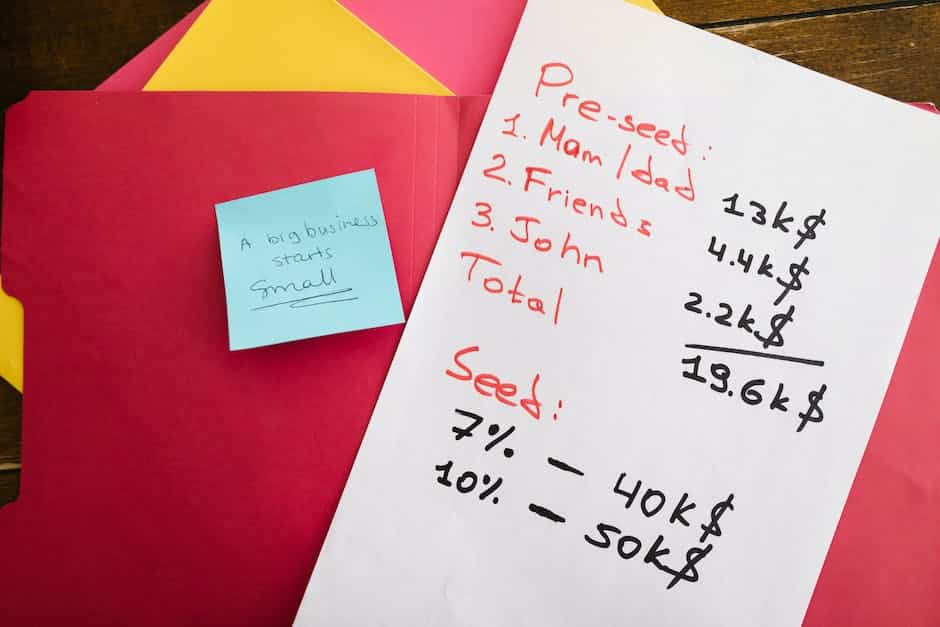

One of the most common ways entrepreneurs fund their startups is by tapping into their savings or using credit cards. This approach allows you to retain complete ownership of your business while avoiding debt or dilution of equity. However, it’s essential to carefully assess your financial situation and consider the potential risks before committing your funds.

2. Friends and Family

Another option for funding your startup is reaching out to friends and family members who believe in your vision. These individuals may be willing to invest in your business or provide loans at favorable terms. When approaching loved ones for financial support, it’s crucial to maintain professionalism and transparency by clearly outlining the risks involved and setting realistic expectations.

3. Crowdfunding Platforms

In recent years, crowdfunding has emerged as a popular way for entrepreneurs to raise capital from many individuals who believe in their idea. Platforms like Kickstarter, Indiegogo, and GoFundMe allow you to showcase your product or service concept and attract backers willing to contribute financially in exchange for rewards or early access.

Grants: Free Money for Your Startup

Grants are an excellent source of non-dilutive funding for startups. These funds are typically provided by government agencies, foundations, or corporations to support innovative projects and stimulate economic growth. Here are some strategies to secure grants for your startup:

1. Research Grants

If your startup is focused on scientific research or technological innovation, you may be eligible for research grants offered by government agencies or private foundations. These grants can provide substantial funding to cover research and development costs, allowing you to bring your innovative ideas to fruition.

2. Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs

The SBIR and STTR programs are federal initiatives that provide funding opportunities specifically tailored for small businesses engaged in research and development. These programs allocate a portion of the federal budget to support startups in various industries, including healthcare, energy, and technology.

3. Corporate Grants and Competitions

Many corporations offer grants or sponsor competitions to support startups that align with their strategic goals or industry focus. These opportunities not only provide financial support but also offer valuable networking and mentorship opportunities that can help propel your startup forward.

Alternative Financing Options

In addition to bootstrapping and grants, there are several alternative financing options available for startups seeking capital without relying on traditional investors:

1. Business Incubators and Accelerators

Business incubators and accelerators provide startups with a supportive environment, mentorship, resources, and sometimes even seed funding in exchange for equity or a small fee. Joining an incubator or accelerator program can give your startup the boost it needs while connecting you with experienced entrepreneurs and potential investors.

2. Microloans

Microloans are small loans, typically ranging from a few hundred dollars to several thousand dollars, offered by nonprofit organizations or community development financial institutions (CDFIs). These loans often have more flexible requirements than traditional bank loans, making them accessible to entrepreneurs who may not qualify for conventional financing.

3. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with individual lenders, cutting out the traditional banking system. These platforms allow startups to access capital from a pool of individual investors willing to lend money at competitive interest rates. Peer-to-peer lending can be a viable option for startups with a solid business plan and credit history.

Conclusion

Funding a startup without investors is challenging but not impossible. By leveraging personal resources, exploring grants, and considering alternative financing options, you can secure the necessary funds to turn your entrepreneurial dreams into reality. Remember, each funding method has advantages and considerations, so it’s essential to carefully evaluate which approach best aligns with your startup’s goals and vision. With determination and resourcefulness, you can fund your startup on your terms and pave the way for success.